Renters Insurance in and around Lewisburg

Lewisburg renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

There’s No Place Like Home

Your personal property matters and so does keeping it safe. Doing what you can to keep it safe just makes sense! That’s why the most sensible step is getting renters insurance from State Farm. A State Farm renters insurance policy can cover your possessions, from your jewelry to your tools. Overwhelmed by the many options? We have answers! Megan Dugan is ready to help you consider your liabilities and help secure your belongings today.

Lewisburg renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

State Farm Has Options For Your Renters Insurance Needs

When renting makes the most sense for you, State Farm can help guard what you do own. State Farm agent Megan Dugan can help you with a plan for when the unanticipated, like an accident or a fire, affects your personal belongings.

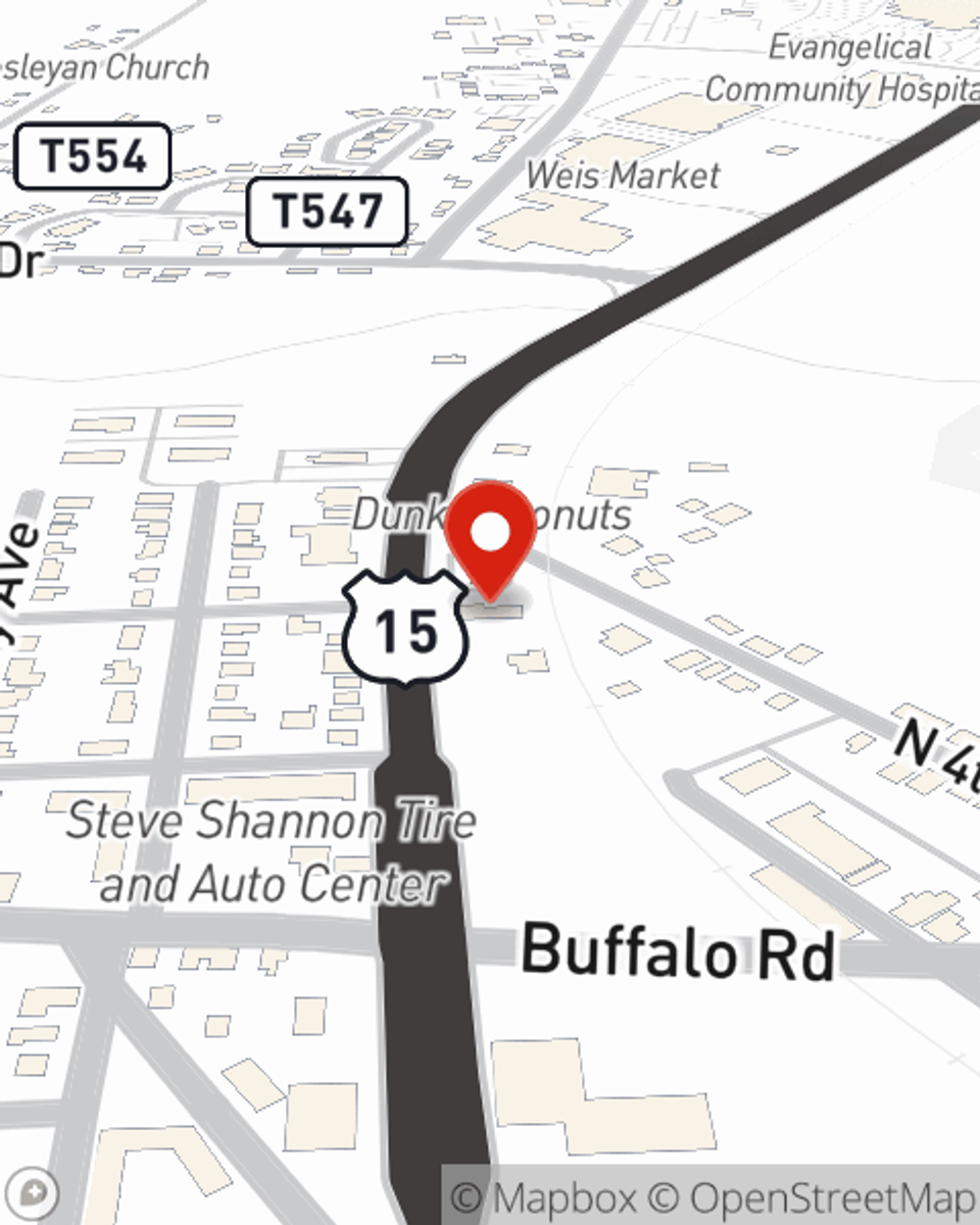

As one of the top providers of insurance, State Farm can offer you coverage for your renters insurance needs in Lewisburg. Call or email agent Megan Dugan's office to talk about a renters insurance policy that fits your needs.

Have More Questions About Renters Insurance?

Call Megan at (570) 524-2884 or visit our FAQ page.

Simple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Megan Dugan

State Farm® Insurance AgentSimple Insights®

What to do after a house fire

What to do after a house fire

Consider these tips to help you and your family recover after a house fire.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.